Description

What We Deliver

- Account and Email access.

- Virtual phone number access.

- Full KYC Support with documents.

- Documents ( NID/Passport + selfie with ID + Residence Proof).

- EU/UK/US Identity (you can replace the account,consequently identity and country, by contacting us via telegram. But there should be no need for that as the cards are shippable to any part and address of the world with access without any problem with any vpn (tested).

- 100% Money-Back Guarantee or account replacement if you face any issue.

- 24/7 Customer Support via Telegram contact, provided at the time of purchase.

Why does a revolut business account cost less than a revolut personal account?

Because it is less labor intensive for us to create, so we sell it at a lower price 😉

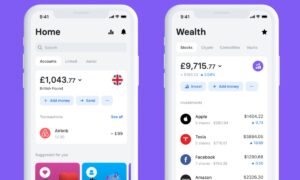

What is Revolut?

Revolut is a leading online banking platform that offers a range of financial services and features to its users. It is a digital banking alternative that allows individuals and businesses to manage their money conveniently and securely through a mobile app. With Revolut, users can perform various banking activities such as sending and receiving money, making payments, exchanging currencies, and accessing additional financial services.

Revolut aims to simplify the banking experience by providing a user-friendly interface, competitive exchange rates, and innovative features. It operates on a digital-first model, eliminating the need for physical branches and enabling users to perform most banking tasks directly from their mobile devices.

One of the key advantages of Revolut is its ability to facilitate international transactions and currency exchange at favorable rates. Users can hold and manage multiple currencies within their Revolut accounts, making it convenient for frequent travelers, digital nomads, and individuals with global financial interests.

In addition to basic banking services, Revolut offers various premium features depending on the account type. These features may include travel insurance, airport lounge access, cryptocurrency trading, budgeting tools, and more. Revolut also provides users with detailed spending analytics, real-time notifications, and advanced security measures to protect their accounts.

Overall, Revolut is revolutionizing the way people manage their finances by combining the benefits of traditional banking with the convenience of modern technology. It offers a seamless and flexible banking experience that adapts to the needs of today’s digitally connected individuals and businesses.

Benefits of Buying a Verified Revolut Account

- Enhanced Security: A verified Revolut account offers robust security measures, protecting your funds and personal information from unauthorized access.

- Global Currency Exchange: Enjoy the convenience of exchanging currencies at competitive rates, making international transactions a breeze.

- Convenient Money Transfers: Transfer money effortlessly to friends, family, or businesses across the globe with Revolut’s seamless transfer feature.

- Multi-Currency Accounts: Hold and manage multiple currencies within a single account, avoiding the hassle of dealing with separate accounts for different currencies.

- Access to Premium Features: With a verified Revolut account, you gain access to premium features such as travel insurance, airport lounge access, and more.

The Process of Buying a Verified Revolut Account

- Research Reputable Sellers: Begin by researching reputable sellers who offer verified Revolut accounts. Look for reliable platforms and sellers with positive customer reviews and a track record of delivering quality accounts.

- Verify Seller’s Credentials: Before making a purchase, ensure that the seller is trustworthy and provides genuine accounts. Look for verification badges or certifications that validate their authenticity.

- Check Account Details: Carefully review the account details provided by the seller, including account type, currency options, and associated benefits. Ensure that the account aligns with your specific requirements.

- Confirm Security Measures: Verify the security measures implemented by the seller to protect your account and personal information. Strong security protocols, such as two-factor authentication, are crucial for ensuring the safety of your funds.

- Purchase the Verified Revolut Account: Once you’ve thoroughly assessed the seller’s credibility and the account details, proceed with the purchase. Follow the seller’s instructions and complete the transaction securely.

Is it worth having a Revolut card?

Assuming you’re referring to the Revolut card rather than the Revolut account, let me tell you that the Revolut card is an excellent choice for your travel expenses. What makes it particularly appealing is the fact that it doesn’t impose any foreign transaction fees. This means that you can freely use your card for payments while traveling without worrying about incurring additional charges. Furthermore, since the Revolut card is a Mastercard, it is widely accepted at most establishments around the world, making it a convenient payment option wherever you go.

It’s important to note, however, that when you use your Revolut card outside of your home country, there is a 2% currency conversion fee. This fee is applicable if you make transactions in a currency different from the one associated with your card. However, if you’re able to conduct all your spendings in the local currency of the country you’re visiting, you can avoid this fee altogether. By simply opting to pay in the local currency, you can ensure that you get the most out of your Revolut card without any additional charges.

Considering the benefits it offers, I believe that the Revolut card is definitely worth having, especially if you’re a frequent traveler. Its fee-free foreign transactions and wide acceptance make it a convenient and cost-effective choice. Just be mindful of the currency conversion fee if you plan to use it in different currencies. With the Revolut card in your wallet, you can travel with peace of mind, knowing that you have a reliable and efficient payment option at your disposal.

Buy Revolut Business Accounts

Revolut provides a range of services catering to both individuals and businesses. These services encompass various aspects such as online account management, cryptocurrency trading, international money transfers, and mobile phone and travel insurance. Additionally, Revolut offers the option to purchase Revolut Business accounts, tailored specifically for the needs of businesses.

For individuals, Revolut offers a comprehensive online banking platform that allows users to manage their accounts efficiently and securely. With features like budgeting tools, spending analytics, and instant notifications, individuals can gain better control over their finances and make informed decisions. Moreover, Revolut enables users to trade cryptocurrencies, providing a convenient platform for crypto enthusiasts to buy, sell, and hold digital assets.

In terms of financial transactions, Revolut simplifies international money transfers by offering competitive exchange rates and low fees. This makes it an attractive choice for individuals who frequently engage in cross-border transactions, whether for personal or business purposes. Furthermore, Revolut’s mobile phone and travel insurance options provide added convenience and security, ensuring that users have access to comprehensive coverage wherever they go.

For businesses, Revolut Business accounts offer a suite of features designed to streamline financial operations. With these accounts, businesses can manage their finances effectively, including sending and receiving payments, handling expenses, and tracking transactions. Revolut Business accounts provide businesses with the tools they need to operate smoothly and efficiently in a digital world.

Whether you’re an individual looking for seamless online banking services, a cryptocurrency enthusiast seeking a reliable trading platform, or a business in need of efficient financial management tools, Revolut offers a wide range of services to meet your needs. With its user-friendly interface, competitive rates, and innovative features, Revolut continues to redefine the way individuals and businesses approach their financial affairs.

Can I open a Revolut personal account online?

Absolutely! Opening a personal Revolut account is a quick and easy process that can be done entirely online. All you need to get started is a valid email address, phone number, and proof of identification, such as a passport or driver’s license.

Once you’ve gathered the necessary information, you can proceed to open your Revolut account right from the comfort of your own home. The online application will guide you through the steps, and you’ll be asked to provide the required details for verification purposes.

After successfully opening your account and verifying your identity, you can start using Revolut immediately. As a bonus, you’ll receive a free virtual debit card, which can be used for online purchases or in physical stores worldwide. The virtual card allows you to make secure transactions and manage your expenses digitally.

If you prefer to have a physical debit card, Revolut offers that option as well. You can easily order a physical card free of charge. This physical card can be used just like any other debit card, enabling you to make payments in person at various establishments or withdraw cash from ATMs.

Revolut’s user-friendly interface and streamlined account setup process make it a convenient choice for those seeking a digital banking solution. By opening a Revolut account, you gain access to a range of features and benefits that enhance your financial management and provide flexibility in your spending habits.

Start your journey with Revolut today and enjoy the convenience of a personalized account, a free virtual debit card, and the option to obtain a physical card for all your financial needs. Experience the freedom and ease of managing your money with Revolut.

Frequently Asked Questions (FAQs):

Q: What is a verified Revolut account?

A verified Revolut account is an online banking account that has undergone a verification process to ensure its authenticity and security. It offers enhanced features, benefits, and increased transaction limits compared to standard Revolut accounts.

Q: Why should I buy a verified Revolut account instead of creating one myself?

Buying a verified Revolut account saves you time and effort. You can acquire a fully verified account instantly, skipping the lengthy verification process and gaining access to premium features from the start.

Q: Are verified Revolut accounts legal?

Yes, buying and using a verified Revolut account is legal. However, it is essential to purchase accounts from reputable sellers to ensure legitimacy and avoid any potential issues.

Q: Can I trust sellers offering verified Revolut accounts?

To ensure trustworthiness, it’s crucial to research and select sellers with positive reviews and a reputation for delivering authentic and verified Revolut accounts. Look for trusted platforms and verify the seller’s credentials before making a purchase.

Q: What are the security measures in place to protect a verified Revolut account?

Verified Revolut accounts incorporate strong security measures, such as two-factor authentication, device authorization, and transaction notifications. These measures help protect your account from unauthorized access and ensure the safety of your funds.

Q: Can I link my existing bank account to a verified Revolut account?

Yes, you can link your existing bank account to your verified Revolut account. This allows you to transfer funds between accounts and take advantage of Revolut’s features while maintaining your connection to your primary bank.